Invest in Tomorrow's Breakthroughs

Access a curated selection of high-potential concepts with institutional-grade due diligence and transparent metrics.

Vetted Concepts

142+

Carefully selected from over 1,750 applications

Average IRR

27.4%

For concepts that have reached exit or Series A

Active Investors

3,450+

Accredited investors from 32 countries

Success Rate

78%

Of funded concepts reaching next milestone

Why Invest Through The Concept Store

Our platform combines the high-return potential of early-stage investing with institutional-grade due diligence and a seamless digital experience.

Rigorous Due Diligence

Every concept undergoes a comprehensive four-stage vetting process, with only 8% meeting our standards for listing.

Curated Opportunities

Access a diverse selection of high-potential concepts across multiple sectors, stages, and risk profiles.

Transparent Metrics

Make informed decisions with standardized metrics, verified data, and clear risk assessments for each concept.

Institutional Access

Invest alongside institutional investors in opportunities typically reserved for venture capital firms.

Efficient Process

Complete the entire investment journey—from discovery to funding—in as little as two weeks.

Portfolio Management

Track performance, receive updates, and manage your investments through our comprehensive dashboard.

Investment Strategies

Discover approaches to concept investing that align with your financial goals and risk tolerance.

Diversified Portfolio Approach

Build a diversified portfolio of concept investments to balance risk and maximize potential returns. This approach acknowledges the high-risk nature of early-stage investing while positioning your portfolio to capture outsized returns from successful concepts.

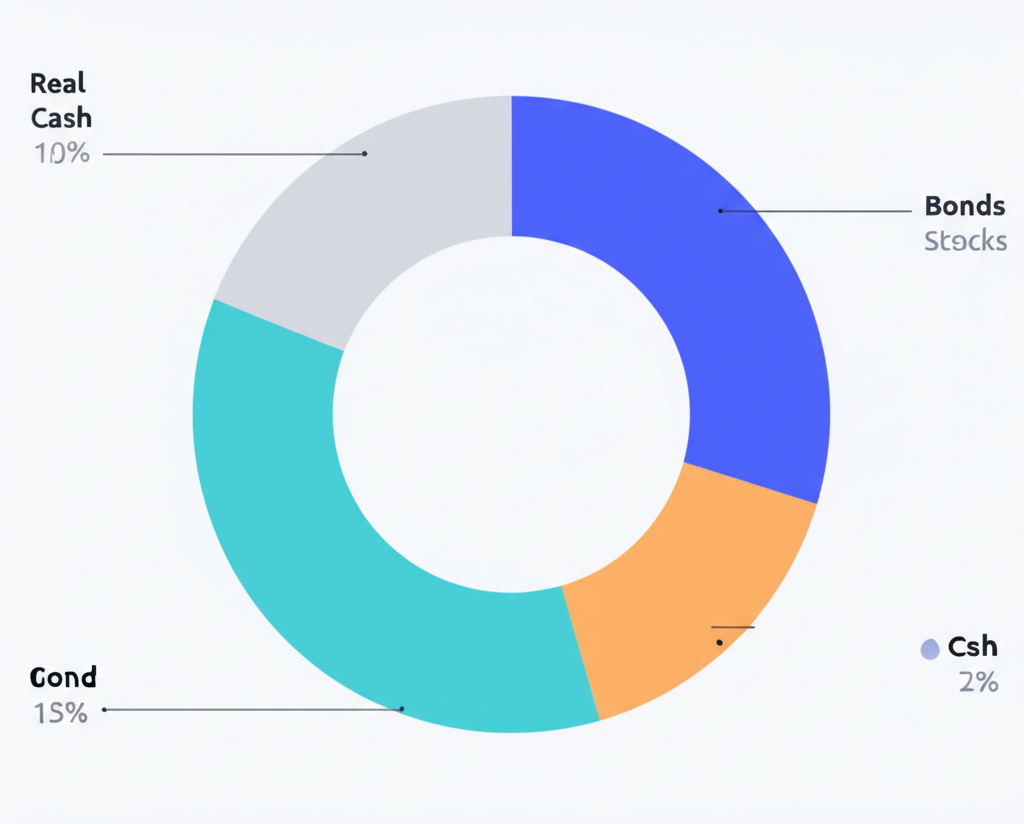

Allocation Strategy

Allocate 5-10% of your investment portfolio to early-stage concepts, spread across 10-15 different opportunities.

Diversification Principles

Diversify across sectors, stages, geographies, and founding team profiles to reduce concentration risk.

Time Horizon

Plan for a 5-7 year investment horizon, with the understanding that early-stage investments often require patience.

Sample Portfolio Allocation

Market Insights

Stay informed with our latest analysis of emerging trends and investment opportunities.

The Rise of Vertical AI Solutions

How industry-specific AI applications are creating new investment opportunities across healthcare, finance, and manufacturing.

Climate Tech Investment Landscape

Analyzing the surge in climate tech funding and identifying the most promising subsectors for early-stage investors.

Web3 Beyond the Hype

Separating signal from noise in the Web3 ecosystem and identifying sustainable business models with genuine utility.

Investor Resources

Access tools, guides, and educational content to enhance your investment strategy.

Investment Guides

Comprehensive guides on concept evaluation, due diligence, and portfolio construction.

Financial Tools

Interactive calculators for return modeling, portfolio allocation, and risk assessment.

Educational Library

Articles, case studies, and research papers on early-stage investing strategies.

Investor Community

Connect with fellow investors to share insights, discuss opportunities, and form syndicates.

Investor Education Series

Our comprehensive 6-part video series covers everything from concept evaluation frameworks to portfolio management strategies. Designed for both new and experienced early-stage investors.

Fundamentals of Concept Investing

45 min

Due Diligence Masterclass

52 min

Valuation Methodologies

38 min

Portfolio Construction Strategies

41 min

Investor Success Stories

Hear from investors who have successfully funded concepts through our platform.

The Concept Store has transformed my approach to early-stage investing. Their due diligence process is exceptional, and the platform's tools have helped me build a diversified portfolio of high-potential concepts that would have been inaccessible otherwise.

David Chen

Angel Investor & Former VP at Goldman Sachs

As an impact investor, I appreciate the platform's rigorous assessment of both financial potential and social impact. My portfolio of climate tech and healthcare concepts is not only generating strong returns but creating meaningful change in the world.

Maya Johnson

Founder, Horizon Impact Partners

Ready to Start Your Investment Journey?

Join thousands of accredited investors who have discovered breakthrough concepts on our platform.

Creating an account is free. Investment minimums start at $25,000 for accredited investors.